Scheme Form | Loan Assistance Standards | Small Scale Self-employment Oriented Business Vehicle Loan Scheme 2022

Small Scale Self-employment Oriented Business Vehicle Loan Scheme 2022

- Onroad unit cost for self-employed vehicles like rickshaws, loading rickshaws, Maruti Ecos, jeep-taxis etc.

- Up to Rs.10.00 lakh for any self-employed business like business or grocery store, medical store, readymade garment store, bookstore etc. or the actual expenses, whichever is less, will be provided by the corporation on loan.

- Transport, logistics, travelers, food courts, etc. will be eligible for 3% interest subsidy on a loan of Rs.

Lending criteria for self-employment schemes 2022

- The applicant must have a valid license in the vehicle loan scheme.

- The vehicle obtained will have to be mortgaged (hypothecation) towards the corporation.

- The loan has to be repaid in equal monthly installments of five years after three months of receipt of the vehicle.

- The small business will have to start within three months of getting the loan and after three months after starting the business the loan will be recovered in the same monthly installment of five years.

- For a loan amounting to a total of Rs.2.50 lakh or less, the beneficiary will have to incur a burden on his or her relative's property worth one and a half times the loan amount.

- If the total loan amount is more than Rs. 3.50 lakh, the total amount will have to be mortgaged in favor of one's own or any other relative's real estate corporation.

- Each borrower will have to provide five post dated checks signed in favor of the corporation.

All self-employment schemes will also have the following qualifications.

- Applicant should be a native of Gujarat and belong to non-reserved category.

- The age of the applicant should be between 18 years to 30 years.

- The interest rate on the loan will be 5% per annum for simple interest and 3% for women.

- The same amount will be lent per year. Simple interest will be considered accordingly.

Interest rate : The interest rate on the loan will be 5% per annum for simple interest and 5% for women.

Income limit : Annual income limit of the family is Rs. 4.00 lakhs or less.

Important Links

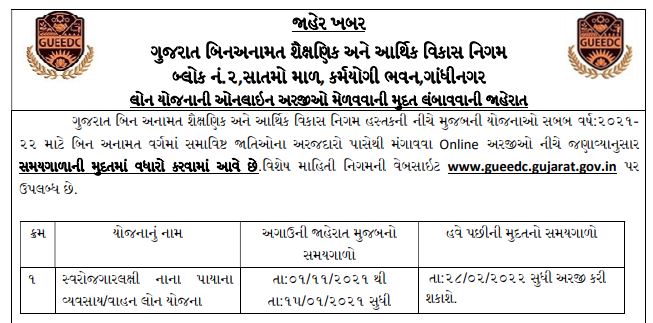

Important Date

Application Last Date Before Apply 28/02/2022